In the announcement of Budget 2014 every property owners have to pay RPGT at a 30 for properties sold within 3 years or less 20 for properties disposed within 4 years and 15 for properties disposed in 5 years. Act 2017 came into effect with amendments to the Real.

Understanding The Concept Of Real Property Gains Tax Rpgt Wma Property

Other income is taxed at a rate of 26 for 2014 and 25 for 2015.

. Featured Videos 07 Apr 2022 0931pm Featured Evening 5. New RPGT Rate for YA 2016. Version 1 - 6-Jan-2016 1.

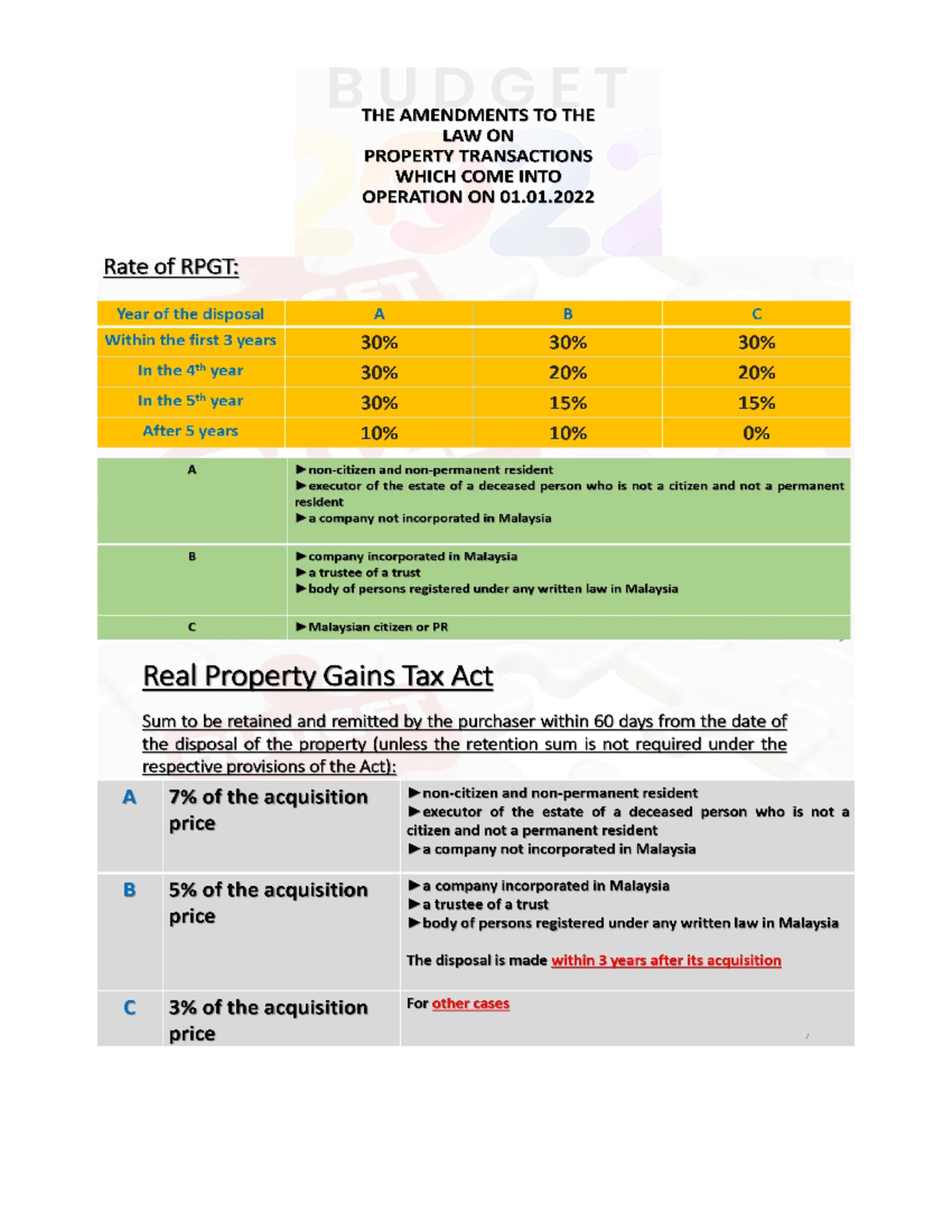

Individuals who are not Malaysian citizens will be subject to RPGT at the rate of 30 for a holding period up to 5 years and 5 for a holding period exceeding 5 years. Real Property Gains Tax Scope RPGT rates Returns and assessment Date of disposal Withholding by acquirer Payment by disposer Exemptions Stamp Duty Basis of taxation Rates of duty Stamping. For the period of 112022 and thereafter disposal in the sixth year after the date of acquisition of the chargeable asset is changed back to nil.

Corporate Tax Rates in Malaysia The corporate tax rate is 25. The new amendment introduced a new subsection to the RPGT Act Section 21B 1A which increased the rate from 3 to 7 for a disposer who is not a citizen and not a permanent resident. For Malaysian citizens and permanent residents the rate was raised to 5 from 0.

Applying the example above the disposal period of A would have been within 3 years ie. These proposals will not become. Which year is the year of disposal for Thomas.

New RPGT Rate for YA 2017. Determination Of Chargeable Gain Allowable Loss. Able to key in in Seller or Buyer Name.

On the First 2500. The current rates for RPGT based on Schedule 5 of the Real Property Gains Tax Act 1976 are as follows. Calculations RM Rate TaxRM 0 - 5000.

The 2019 Real Property Gains Tax rates are a significant factor for consideration to anyone who owns a property and intends to profit from its sale. I believe it impacts a lot more on long-term property investors over short-term speculators who gain from flipping properties. How much RPGT Thomas has to pay.

Disposal in 6 th year and subsequent year. Version 6 - 23-Aug-2011 1. And with the new RPGT rates announced in the Malaysian Budget 2019 Malaysian citizens will now be charged 5 in property taxes after the 5th year as well where it used to be 0.

Sale of shares by Bee in Kaca Sdn Bhd to Axim Sdn Bhd on 20 December 2018. Non-citizens and companies on the other hand will be charged 10 RPGT when they dispose of their property after more than five years from purchasing it. Above RPGT Rates in Malaysia as of Budget 2014.

Year of disposal date on New SPA - date on old SPA 14 April 2020 - 16 November 2017 3rd Year 2. Version 1 - 2-Feb-2015 1. The RPGT rates as at 201617 are as follows So if youre a Malaysian citizen and you sell a property after holding it for four years you would be liable to pay RPGT at 20 of the chargeable gain.

It is the imposition of 5 Real Property Gain Tax RPGT for gains received from disposal of properties after the fifth year of owning them. From the period of 112019 until 31122021 disposal in the sixth year after the date of acquisition of the chargeable asset is 5. Disposal by a company Rates of RPGT 010407 311209 Exemption period wef.

From 2015 to 2017. While RPGT rate for other categories remained unchanged. Version 1 - 16-Jan-2017 1.

The following are the rates of RPGT for the following 3 categories. In Budget 2019 the government raised the RPGT rate for the disposal of property held for more than five years by companies non-citizens and non-permanent residents to 10 from 5 previously. Real Property Gains Tax RPGT Rates.

Disposal Date And Acquisition Date. New RPGT Rate for YA 2012. RGPT rate for 3rd Year 30 RPGT Payable selling price - buying price x RPGT Rate RM700000 - RM500000 x 30 RM200000 x 30 RM60000 5.

RPGT payable 35409720 iv. On the First 5000 Next 15000. This booklet incorporates in coloured italics the 2017 Malaysian Budget proposals announced on 21 October 2016.

The exemption is deducted against chargeable gain and the remaining balance would be subjected to RPGT at rate range between 5 to 10 The exemption is given regardless of the citizenship of the individual The exemption does not apply to partnership or a. In the above example where your gain was RM250000 the RPGT payable would be RM 50000. With effect from 1 January 2014 for companies and individuals who are Malaysian citizens and permanent residents a Real Property Gains Tax RPGT rate of 30 will be imposed for a holding period of real property of up to 3 years 20 for a holding period exceeding 3 years and up to 4 years and 15 for a holding period exceeding 4 years and up to 5 years.

The Real Property Gains Tax RPGT in Malaysia is definitely not a new subject for property owners veteran investors especially. Assessment Year 2016 2017 Chargeable Income. RM 50000 RM 250000 x 20.

Lowest Individual Tax Rate is 2 and Highest Rate is 26 for 2014 and Lowest Tax Rate for Year 2015 is 1 and Highest Rate is 25 Non-residents are subject to withholding taxes on certain types of income. Disposal Price And Acquisition Price. Share free summaries past exams lecture notes solutions and more.

Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News

What We Need To Know About Rpgt

Justletak Standard Format Rpgt Calculation

Rpgt Stamp Duty 2022 Rpgt Amendment Tru1 Studocu

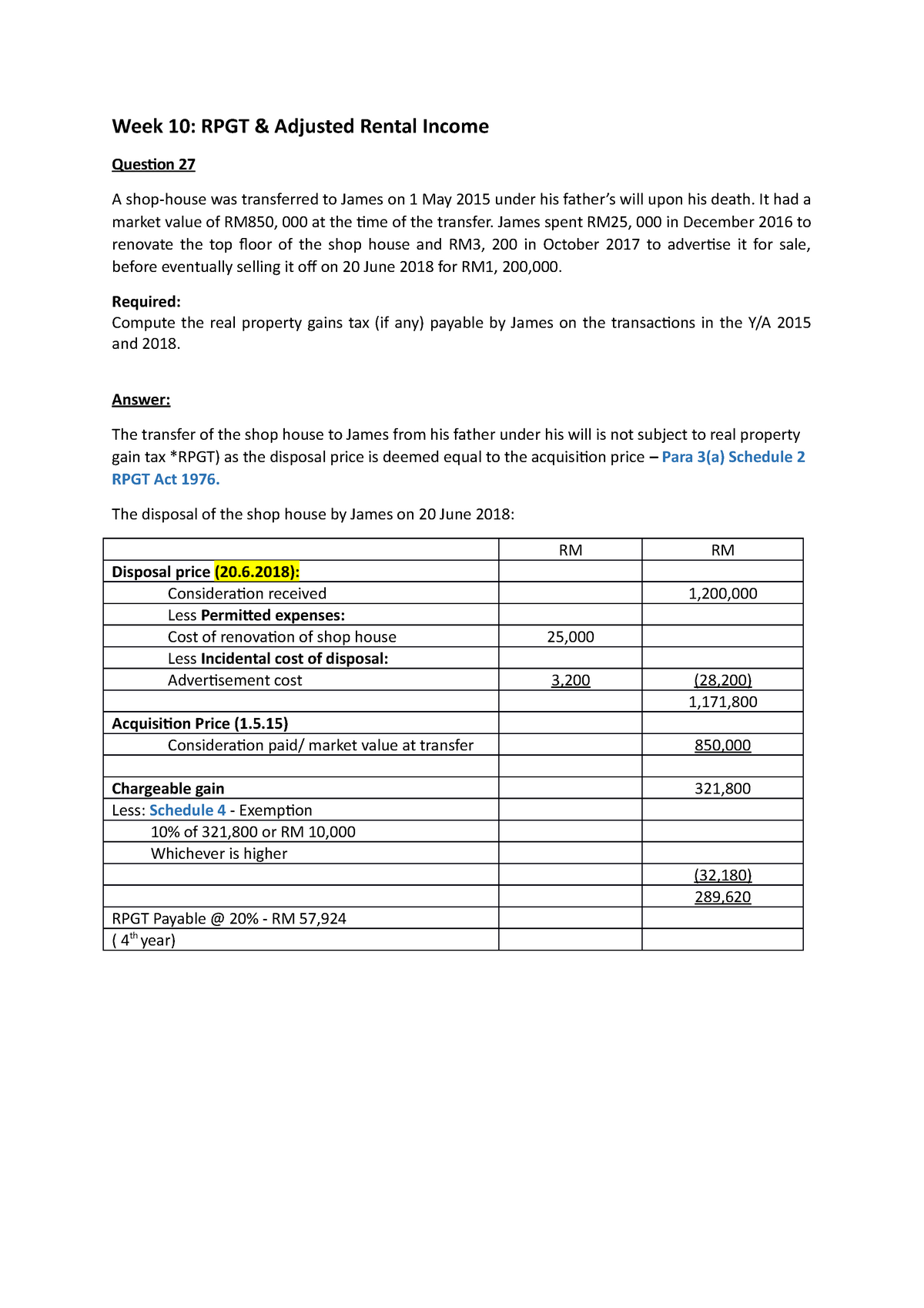

Rpgt Rpgt Answers Week 10 Rpgt Amp Adjusted Rental Income Question 27 A Shop House Was Studocu

Malaysia Wakala Sukuk Berhad Usd800 Million And Usd500 Million Offering Memorandum Islamicmarkets Com

What We Need To Know About Rpgt

Ppt Real Property Gain Tax Powerpoint Presentation Free Download Id 4503504

Real Property Gains Tax Part 1 Acca Global

Real Property Gains Tax Part 1 Acca Global

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

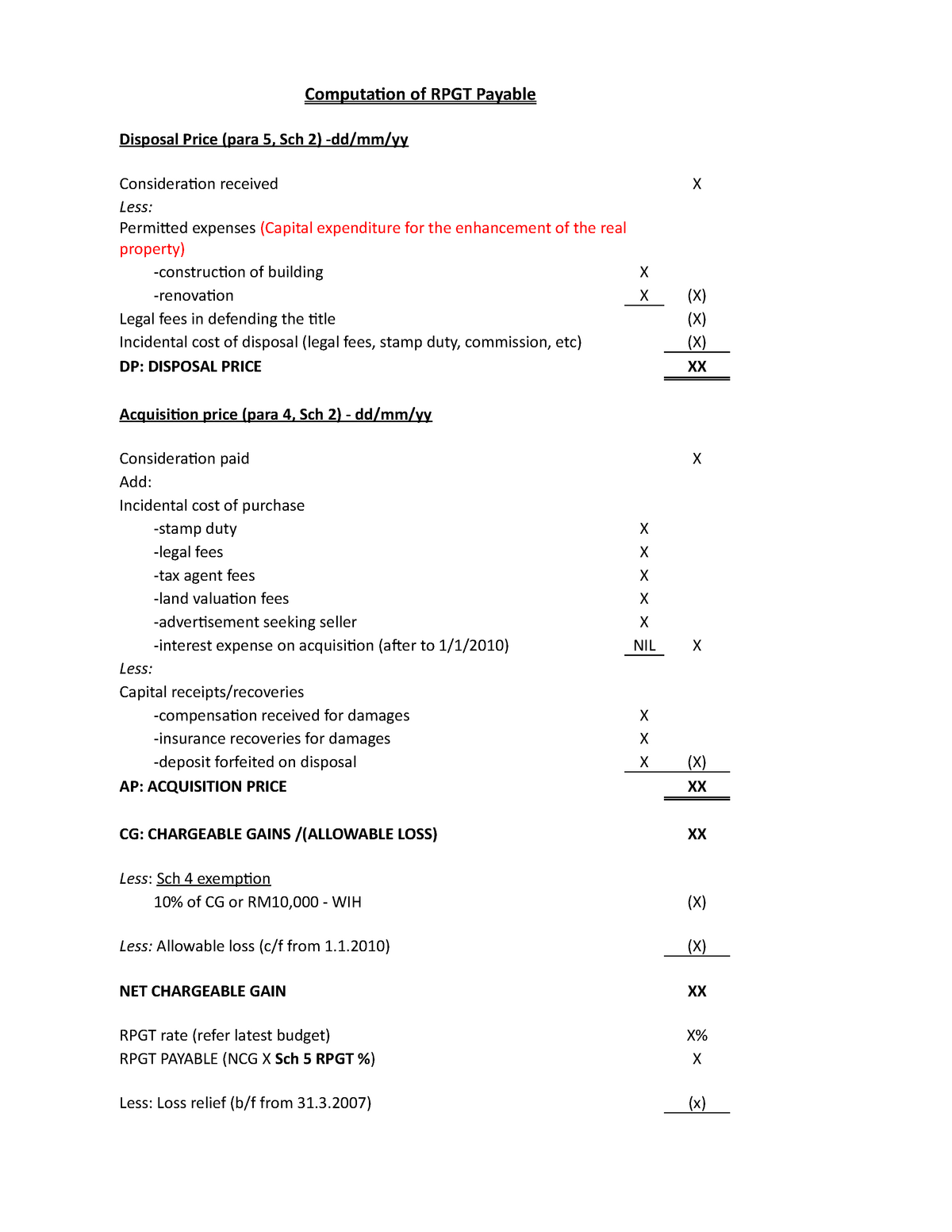

Format Of Rpgt Payable Revised Computation Of Rpgt Payable Disposal Price Para 5 Sch 2 Studocu

Malaysia Finance Blogspot Rpgt Should Not Be Calculated From Year 2000 But 2013

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

October 2018 Legally Malaysians